san francisco sales tax rate breakdown

4 rows Sales Tax Breakdown. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

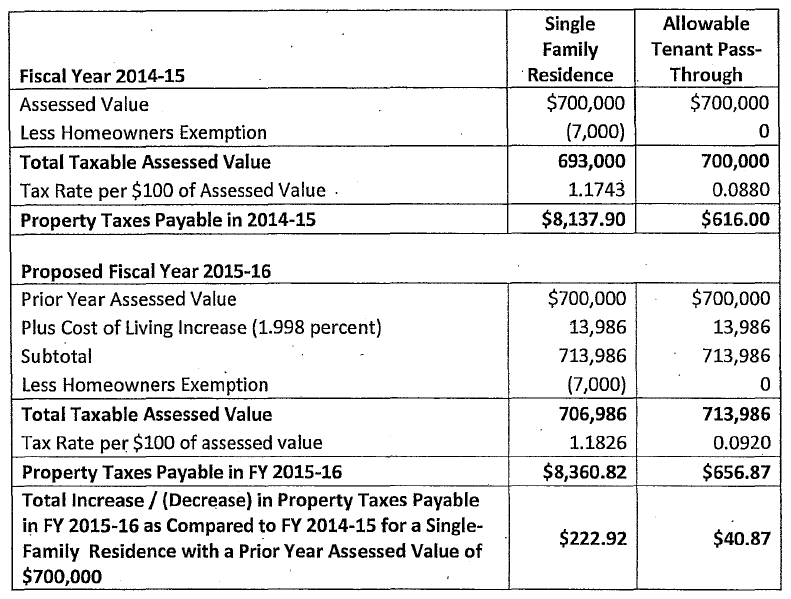

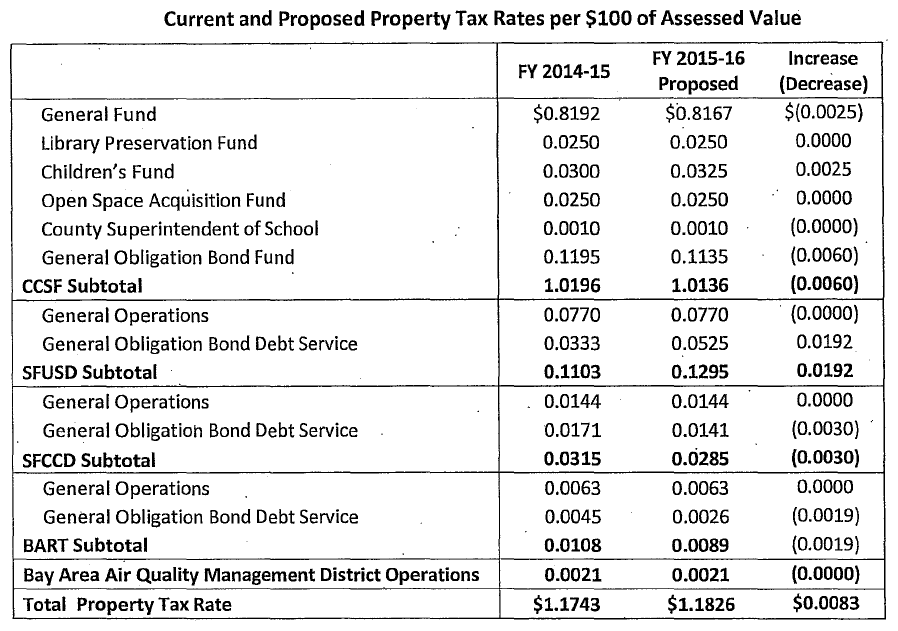

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

The last time the Board of Supervisors adjusted local sales taxes was in 1993.

. Fast Easy Tax Solutions. The San Francisco County California sales tax is 850 consisting of 600 California state. This table shows the total sales tax rates for all cities and.

The sales and use tax rate varies depending where the item is bought or will be used. For a full historical description of sales tax rates and beneficiaries in San Francisco and. The total sales tax rate in any given location can be broken down into state county city and special district rates.

San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. District tax areas consist of both counties and cities. Presidio of Monterey Monterey 9250.

4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. The sales tax amounts in the interactive map above represent only the collections attributable to local Bradley-Burns portion of sales tax from 2011 to 2016.

Integrate Vertex seamlessly to the systems you already use. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent. Presidio San Francisco 8625.

The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. File Monthly Transient Occupancy Tax Return. Ad Find Out Sales Tax Rates For Free.

By state law local governments can enact up to. 3 rows Sales Tax Breakdown. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The transient occupancy tax is also known as the hotel tax. A base sales and use tax rate of 725 percent is applied statewide.

Prop K Sales Tax For Transportation And Homelessness Spur

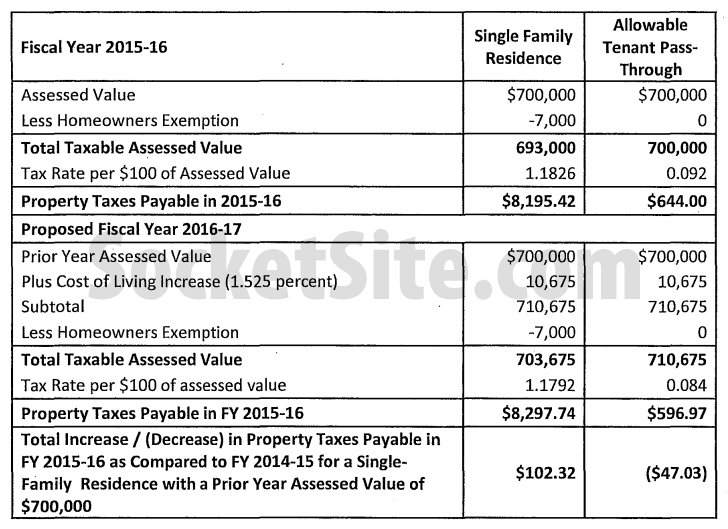

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Understanding California S Sales Tax

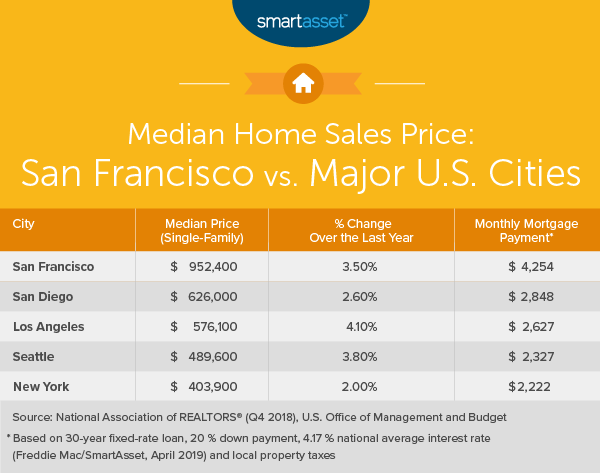

What Is The True Cost Of Living In San Francisco Smartasset

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

How To Calculate Cannabis Taxes At Your Dispensary

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Us Sales Tax On Orders Brightpearl Help Center

Why Households Need 300 000 To Live A Middle Class Lifestyle

Sales Tax Collections City Performance Scorecards

Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Why Households Need 300 000 To Live A Middle Class Lifestyle

Data Shows Steep Drop In Sf Sales Tax Revenue Possible Decline In Population The San Francisco Examiner